Shopping Too Much? How to Stop Overconsumption For Good

What You Need to Know About Overconsumption

Shopping has become easier than ever, which makes overconsumption more common, tempting, and normalized.

Overconsumption can impact your mental well-being, increase stress, and clutter your home and mind.

Avoiding consumerism isn’t about deprivation. It’s about spending intentionally, in ways that support your values, goals, and peace of mind.

What Is Overconsumption?

Consumerism is the idea that buying more equals feeling better. That if we just consume a little more, whether it’s skincare, tech, or takeout, we’ll be happier. On top of that, we’ve been conditioned to believe that buying things is not just good for us as individuals, but it also helps stimulate the economy. This means a lot of financial policy has been built around encouraging us to keep buying.

The pressure to keep spending comes with a cost that extends beyond its impact on our checking account. Constant consumerism can lead to burnout, anxiety, and that never-enough feeling. And it’s not just a personal issue; it also has major environmental and societal impacts.

Constant buying and consuming can lead to emotional burnout, clutter, and chronic dissatisfaction. It creates a cycle where we seek short-term joy through shopping but end up with long-term stress.

In this post, you’ll learn why shopping is so tempting, how to prevent or limit it from happening, and finally, tips to help you break the cycle of consuming more.

The Psychology of Overspending: Why Shopping Feels So Tempting

Shopping itself isn’t inherently bad. Each time we buy something, we get a quick burst of feel-good chemicals: dopamine, serotonin, oxytocin, and endorphins (Psst, I have a whole blog and video all about this phenomenon you can check out here). That hit of happiness is real. It’s why we often shop when we’re feeling down, overwhelmed, or bored. That new outfit or skin serum can temporarily lift our mood.

But that reward is short-lived. Once the box is opened or the tags are ripped off, the high fades, and often, guilt creeps in. Many of my clients describe this as a kind of spending hangover. The item didn’t bring the joy they expected, and now they feel stuck with more stuff and less money, which makes them feel bad about themselves.

Marketing teams lean hard on this emotional loop. They know urgency sells, so you’ll see messaging like:

“Today only!”

“Almost sold out!”

“Just for you.”

“Don’t miss this exclusive sale.”

These phrases tap into our fear of missing out and our desire to feel special or seen.

Cheap Stuff = Too Good to Be True

Cheap, low-quality products often come at a hidden cost. As Kara Perez from Kara Explores Money (formerly We Bravely Go) points out, items like fast fashion are often made with low-quality fabrics, cheap buttons, and zippers.

But even more concerning, they’re usually produced in unsafe working conditions, and the labor of the people who make these products is often unpaid or underpaid. As consumers, we must recognize that cheap purchases are not always as appealing as they seem.

Preventing Overspending

I’m not going to shame your morning latte or your favorite lipstick or tell you to freeze all your spending. But I am here to help you understand your spending patterns with compassion so you can make choices that feel good during and after the purchase.

If your shopping habits start feeling more reactive than intentional, it might be time to hit pause. Shopping too much is a sign of consumerism, but there are a few ways to add friction to the temptation to “add to cart.”

1. Pause Before You Purchase

Even waiting 15 minutes before clicking “Buy Now” can help. Bonus points if you pause for a full day. This creates space between impulse and action.

Remember: marketers want you to act fast. But your brain and bank account usually benefit from a slower pace.

2. Unsubscribe and Unfollow

Clear out your inbox and your social feeds. Unsubscribe from marketing emails. Unfollow influencers and brands that make you feel like you need to keep up or overspend.

This isn’t about cutting yourself off from joy. It’s about protecting your peace and removing temptation.

3. Reconnect With Your Financial Goals

What’s one big thing you’re working toward financially? A trip? A new home? Starting a business?

Put a visual reminder somewhere you’ll see it, like your phone lock screen or your laptop background. I’ve had clients wrap a sticky note around their credit or debit card with a reminder like, “Will this be better than a vacation?” Reconnecting with your long-term goals helps put short-term temptations into perspective.

Breaking the Consumerism Cycle

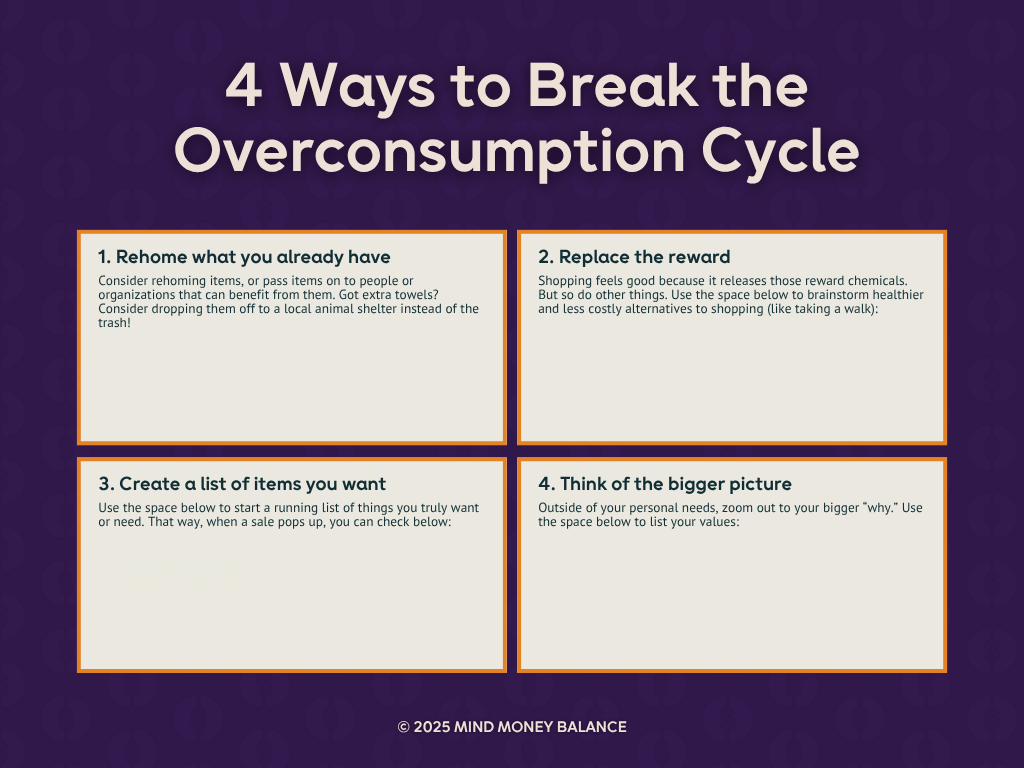

If you’re deep in the shopping-as-my-hobby life, here are some financial therapist-approved ways to break free:

1. Rehome What You Already Have

Consider rehoming items that are in good condition but aren’t useful to you. Rehoming means passing items on to people or organizations that can benefit from them. This is a way to engage in true community reciprocity.

Think beyond donating clothes and shoes at your local thrift store (though that’s great, too!). Animal lovers can donate old towels to shelters. Bookworms can drop gently used books in neighborhood Little Free Libraries. Even kids can join in, helping re-home books or toys to other families.

2. Replace the Reward

Shopping feels good because it releases those reward chemicals. But so do other things. Instead, try:

Going for a short walk

Texting a friend to vent or catch up

Doing a quick chore you’ve been putting off

Sending a postcard to someone you love

Baking something while listening to a podcast

Here’s a trap I know well: trying to solve clutter by buying more stuff to organize the clutter. (Hi, $80 bins from IKEA.) Recently, I was browsing organizational solutions for my office closet, when I decided to take everything out. Turns out, I’d been treating my closet like a giant junk drawer, and tossing, donating, and recycling took care of most of my “organizational” problems. Sometimes the real fix isn’t better organization, it’s simply letting go of what you don’t need.

3. Make a “Want List”

Keep a running list of things you truly want or need. I do this on my birthday in a Google Doc. That way, when a sale pops up, you can check the list. If it’s not on there, you can pass. If it is on there, congrats! You get a deal and intentionality.

4. Consider the Bigger Picture

Outside of your personal needs, zoom out to your bigger “why.”

If sustainability matters to you, consider the carbon footprint and packaging waste associated with that purchase. If you care about human rights, ask if buying another fast-fashion piece that uses questionable labor practices aligns with your values.

Spending in alignment with your values is a powerful way to resist consumerism.

A Simple System Matters

Keep it doable. You don’t need fancy apps or color-coded spreadsheets. Even writing down every non-essential purchase for a week can give you valuable insight into your consumer habits.

If that sounds overwhelming, try setting a “fun money” amount each month and spend freely within it. A simple system like this gives you permission to play, knowing that you’re splurges won’t derail you from a larger financial goal.

Resist Consumerism Intentionally

Avoiding consumerism isn’t about never spending. It’s about spending with clarity. When you pause, reflect, and act with intention, your purchases feel more fulfilling. They support your goals, your mental health, and maybe even your community.

So the next time you feel pulled toward that flash sale, remember: You’re allowed to want things and spend money. But you also get to ask:

Does this align with my values?

Will this bring lasting joy?

Is this something I truly need, or something marketers are telling me I need?

Is this supporting the life I want to build?

Shopping will always feel tempting, because it’s designed to. With a little awareness and intention, you can spend less, and when you do spend, spend in ways that feel lighter, more joyful, and aligned with your values.

Want more support on the emotional side of money? Each week, I share tips, stories, and financial therapist-approved strategies in my Mind Money Balance newsletter below.