Travel Hacking 101: Busting Myths and Using Credit Card Points to Travel

What You Need to Know About Travel Hacking Myths

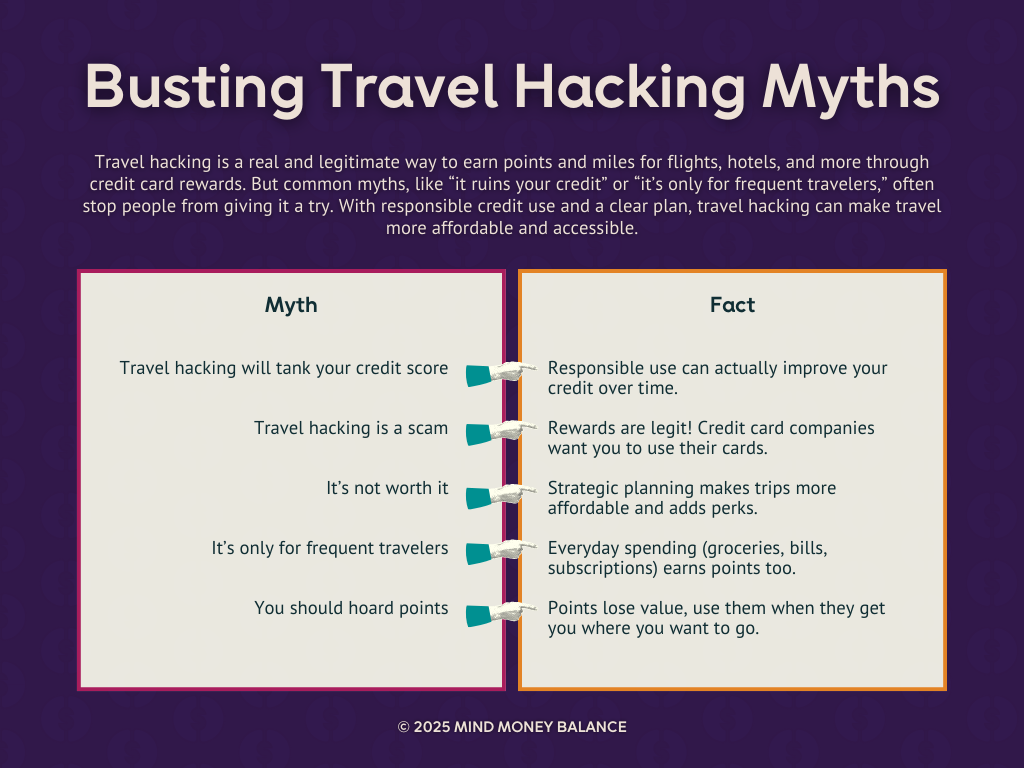

Travel hacking is a legitimate way to earn points and miles for flights, hotels, and more using credit card rewards

Myths like "travel hacking ruins your credit" or "it's only for frequent travelers" stop many people from trying it

With responsible credit use and a plan, travel hacking can make trips more affordable and accessible

Travel Hacking 101 Part 1: Busting the Biggest Myths

What is travel hacking? Spoiler alert: it’s not stuffing 30 pounds of clothing into your jacket so you can avoid paying for a carry-on. (Although, respect if you’ve done it, couldn’t be me.)

When I talk about travel hacking, I mean using credit card points, loyalty rewards, and bonuses to pay for travel for a fraction of the cost. I’ve traveled all over the U.S., Canada, Europe, and Asia, paying just 1-5% of retail prices by using credit card travel hacking strategies.

But I didn’t start out that way.

I got into this world during an insomnia-fueled night back when I was living paycheck to paycheck and desperately wanted something fun to look forward to. I started entering sweepstakes, and while I did win some quirky prizes (like five bridesmaid clutches and a convection oven), the return on investment wasn’t great.

Eventually, I stumbled into the world of travel hacking. And my mind was blown. But like a lot of people, I had heard myths like:

“It’ll hurt your credit score.”

“It’s a scam.”

“It’s only for people who travel all the time.”

Let’s bust those travel hacking myths one by one.

Myth #1: Travel Hacking Will Tank Your Credit Score

This is probably the biggest fear I hear about travel hacking with credit cards. But when done responsibly, travel hacking can actually improve your credit score. It’s a credit card myth that travel hacking will ruin your credit score, but the credit card facts are a little more complicated.

Let’s start at the top with a refresher of how credit scores are calculated. Credit scores are calculated based on a blend of a few things.

Factors that impact your credit score are:

35% payment history (Did you pay on time?)

30% amounts owed (How much of your credit are you using?)

15% length of credit history (how long have you had access to credit?)

10% new credit (Are you applying for too many credit cards or loans at once?)

10% credit mix (Do you have a mix of credit like credit cards and car loans?)

Paying your credit card bill in full and on time helps with the two biggest components: payment history and amounts owed. Despite the old myth that keeps circulating, you do not need to carry a balance to help your credit. In fact, carrying a balance means you’re paying interest, often at sky-high rates.

Opening a new card may ding your score a few points temporarily, but it typically bounces back within 90 days. Plus, increasing your overall credit limit (without increasing your spending) actually helps your credit utilization ratio.

Pro tip: Instead of closing a card with an annual fee you no longer want, ask your issuer to "product change" to a no-fee version. That keeps your credit history intact.

Myth #2: Travel Hacking Is a Scam

It’s not.

Credit card companies want you to spend money on their cards, and they offer rewards to encourage that. If you stick to your monthly spending plan and pay off your statement in full, you can collect those points without paying interest.

The only time you get "scammed" by travel hacking with credit card points and miles is if you overspend or miss a payment.

Myth #3: It’s Not Worth It

Let me be real with you: travel hacking isn’t instant and it’s not for everyone.

You won’t sign up for a card today and fly to Paris tomorrow. It takes time to:

Meet the minimum spend to earn your sign-up bonus

Wait for the points to post (can take weeks)

Learn which cards and programs make sense for your goals

But if you’re willing to be strategic and plan ahead, it is worth it. Many cards also offer added perks like:

Travel insurance

Rideshare or food delivery credits

TSA PreCheck or Global Entry

Airport lounge access

Purchase protection

Not to mention: credit cards offer more fraud protection than debit cards. If someone steals your credit card info, you’re protected. With a debit card? Not so much.

Myth #4: It’s Only for People Who Travel All the Time

Even if you travel just once or twice a year, you can benefit from travel hacking. Everyday spending on groceries, utilities, and subscriptions can help you rack up points. Then you can use them toward flights, hotels, or even receive cash back.

You don’t need elite status or a suitcase with airline stickers from 18 countries. You just need to be intentional.

Myth #5: You Should Hoard Your Points

Wrong again. Points and miles are made-up currencies. They can lose value at any time. Hotel chains merge. Airlines change their policies. Redemption rates fluctuate.

This feels so counterintuitive if you like to watch your dollars stack up in a savings account, but with travel points and miles, sitting on them and waiting for the "perfect" redemption will backfire, and they often lose value. Use them up!

Some travel hackers obsess over getting the absolute best value, but if you have enough points to get you where you want to go and you’re excited about it? That’s the best redemption.

Even using your points for cashback isn’t a waste if it helps you take that trip you’ve been dreaming of.

What You Need to Know About credit card Travel Hacking

Travel hacking for beginners starts with checking your credit score and knowing your travel goals

Using the right credit card for your spending style and travel plans helps you earn points faster

How to Travel Hack with Points

If you're here, you've already read the above blog or watched the previous video where I busted the myths about travel hacking and you're ready to learn how to travel hack with points.

Before you even start signing up for credit cards, there are two things you need to do:

Check your credit score

To qualify for the best rewards cards, you’ll generally need a score of 670 or higher, and ideally 740+. Why? Because credit card issuers save their best bonuses and most lucrative perks for applicants they consider low-risk. The better your score, the better your options.

You can often see your score through your current credit card account, or use a free tool like Credit Sesame or Credit Karma. If you’ve never checked your credit before, don’t stress. These tools are user-friendly and will even break down what’s helping or hurting your score.

Review your credit report Even more important than the score itself is knowing what’s on your report. Head to AnnualCreditReport.com and check for:

Accounts that don’t belong to you

Incorrect late payment reports

Credit cards or loans you thought were closed but are still open

Disputing errors is a hassle, but it’s worth it. A small mistake could drag your score down and hold you back from travel perks you deserve.

This matters because credit card travel hacking only works if your credit is in a healthy place. And once it is, you’re good to go.

Step One: Know Where You Want to Go

A common beginner mistake? Signing up for a card with a huge sign-up bonus that doesn’t align with where you actually want to travel. Having a clear goal for your travel and credit card helps you make smarter choices and avoid rewards that go unused.

Instead:

Choose your destination first. Do you want a cozy mountain getaway, a Eurotrip, or to finally visit your bestie on the West Coast?

Research what airlines and hotels serve that area. While you might normally be a boutique hotel kinda person, most boutique hotels don’t participate in credit card rewards.

Then look for cards that earn points with those brands, or flexible points that can transfer to them.

Step Two: Choose the Right Type of Credit Card

There are two main types:

Brand-specific cards (like a Delta, Southwest, or a Hilton card) are great if you always fly the same airline or stay in the same hotel chain. These cards often come with status perks like priority boarding or free breakfast.

Flexible rewards cards (like Chase Sapphire Preferred or AmEx Gold) are more versatile. You can transfer points to different airlines or hotels, which gives you more freedom and value. These are ideal for travel hacking beginners.

Beyond point flexibility, consider perks that match your travel personality:

Use Uber or Lyft often? Some cards offer monthly ride share credits.

Hate long security lines? Look for cards that reimburse TSA PreCheck or Global Entry.

Want to start your trip with a mimosa and a comfy chair? Lounge access might be your jam

Step Three: Make a Plan to Hit the Minimum Spend

To earn the sign-up bonus, most cards require you to spend a certain amount in the first 3–4 months, typically in the $1,000 to $4,000 range.

So ask yourself:

What’s my household’s typical monthly spending?

Can I meet that spend without overextending myself? This is super important! You don’t want to apply for a card that you can’t meet the minimum spending requirement on and miss out on a bonus AND you don’t want to spend more just to hit a minimum balance.

You can usually add an authorized user (like a partner or spouse) to help reach the spend more quickly, just make sure everyone’s using that card only until you hit the threshold.

Step Four: Redeem and Repeat

Once you hit your minimum spend and your points hit your account, congrats!

You’ve got options:

Redeem through your credit card’s travel portal: This is the easy, beginner-friendly, but you generally get less value per point

Use points for cash back: If you just want flexibility or you can’t fathom using your points at a hotel chain instead of a boutique glamping option, go ahead an book your travel and use cash back on your credit card statement. It’s not the best use of your points, but it can significantly offset the cost of travel.

Transfer to a travel partner: This option takes a bit of research but can lead to amazing redemptions. This is my preferred method (and how I’m able to snag business class international flights for $11), but I’ve been travel hacking for years! If this is your first time travel hacking with credit cards points or miles, don’t feel bad about redeeming through a travel portal or using cash back.

Now, once you've used those points (again, CONGRATS!), you have two choices for the credit card you opened to earn points:

Keep the card if it fits your lifestyle and the perks still make sense.

Downgrade the card to a more appropriate card for your lifestyle. If the card has a hefty annual fee or you can’t justify the cost, instead of closing the account, ask the credit card issuer for a “product change” to a no-annual-fee card. This preserves your line of credit and credit history.

Now, if you are hankering for another trip, have a plan in place to meet the minimum spend, and know you can pay your credit card off in full without tempting yourself to overspend, you can open another credit card and do it again!

The Best Travel Hack Is the One You Actually Use

Travel hacking with credit cards isn’t a scam, it doesn’t have to tank your credit, and it doesn’t require you to be a full-time traveler.

At the end of the day, the best travel hack is the one you actually use.