Microdosing Financial Wellness Habits

What You Need to Know About Microdosing Financial Habits

Microdosing financial habits means taking small, manageable money actions that support long-term financial wellness

Microdosing helps you build smart money habits by focusing on tiny, repeatable tasks

May lead to increased emotional satisfaction, financial self-trust, and habit formation

How do you feel about money? Anxious? Avoidant? Numb? If you’re feeling uneasy at all, it can make financial habits feel out of reach.

Instead of aiming for a budget overhaul or perfecting your financial tracking, microdosing encourages small, repeatable actions. These build your confidence, create momentum, and help you feel more grounded in your financial decisions.

Whether you're building good money habits from scratch or trying to reconnect with your values, these tips can help you make financial wellness feel doable again.

What Is Microdosing Your Financial Habits?

Microdosing financial habits means taking small, consistent, low-lift actions that support your financial well-being.

As a financial therapist, I often find myself discussing smaller habits with my clients or workshop participants as financial wins, only to have them dismiss them. But you shouldn’t dismiss these. We’ve been conditioned to believe that only big overhauls are worth doing, but microdosing financial habits are wins. They're bite-sized, easy money moves that help you build healthy spending habits and strengthen your financial self-trust.

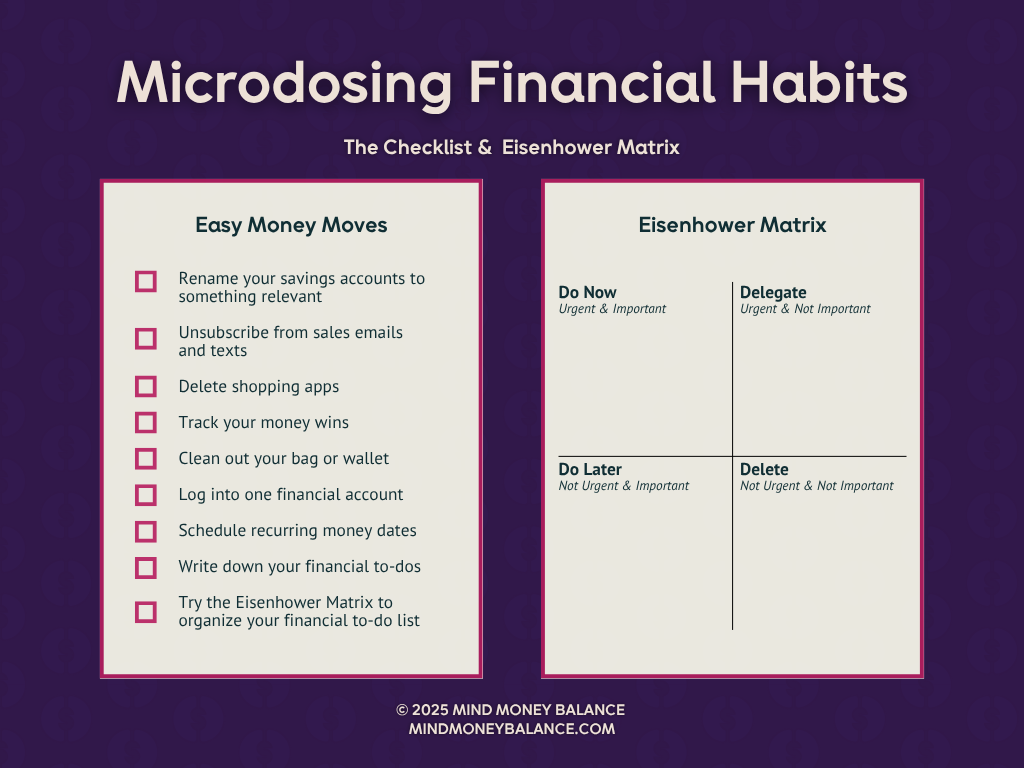

9 Easy Money Moves You Can Microdose Today

Here are nine financial-therapist-approved ways to microdose your financial tasks so you can start healing your relationship with money, build self-trust, and create habits that stick.

1. Rename Your Savings Accounts

Renaming your different savings accounts turns your goals into something you actually care about. It’s a quick mindset shift, and one of the most underrated good money habits around. Anytime I’m working on a new money goal, I always change the account name from something generic like “Savings Acct -1234” to something that reflects with crystal clear clarity what the savings account is for. Past account names include: Fun Money Fund, Kitchen Reno, and New Puppy. I’ve heard people rename their Emergency Fund Account to: Don’t F***ing Touch, Safety Net, and Peace of Mind.

2. Unsubscribe from Sales Emails and Texts

Marketing emails are designed to make you spend. Take a moment to unsubscribe from promo emails or texts that yell “LAST CHANCE!” Let your inbox breathe by unsubscribing from brands or shops you haven’t opened in a while, or that tempt you to spend more than you’re comfortable spending. Gmail even prompts you when it’s time to clear some out. Take that nudge.

3. Delete Shopping Apps

Commerce and shopping apps aren’t just your typical big box store apps, they can also include things like a “last-minute flight deal” apps and eBay. If those apps tempt you, delete them from your phone. If that feels like overreach, at least turn off notifications. You don’t need constant reminders to spend money, and removing some of the temptation to spend can help create healthy spending habits.

4. Track Your Money Wins

You don’t need a fancy planner to feel good about money. Just open your Notes app and jot down a small financial win. When you track what’s going right, you train your brain to associate money with success. This builds your self-trust and supports a healthier relationship with money over time. Track micro-wins like:

“Skipped impulse buy at checkout”

“Packed lunch and actually ate it”

“Transferred $10 to savings”

You can do this daily or weekly, whatever rhythm works best for your life. When I’m working on creating a new habit (or, as an ADHDer, find habits tricky to set), I set a phone reminder to alert me each day.

5. Clean Out Your Bag or Wallet

Think of this like a money-focused self-care ritual. Empty out your bag or wallet, toss old receipts, shred expired cards, and make space. This small organizing habit creates a sense of calm and order, which can go a long way when your money life feels chaotic.

Bonus: You might find a forgotten gift card or cash! True story, I found a local wine shop gift card during my last purse cleanout and treated myself 🍷.

6. Log In to One Financial Account

Just open the app or website. Check your balance. That’s it.

This is one of the simplest and most powerful good money habits: just log in and take a look. No need to change anything or make a plan. Simply being in touch with what’s in your checking, savings, or credit account helps you stay connected without spiraling into shame or avoidance. Over time, this gentle awareness builds confidence and reduces the fear of “what might be in there.” It also helps build familiarity with an app's dashboard, reducing the sensation of overwhelm or confusion.

7. Schedule Recurring Money Dates

You don’t need to do anything yet, just pick a day and block it off. Whether it’s once a month or once a quarter, setting aside time to sit down with your money builds a routine and helps you engage more intentionally. Consider this your nudge to open your calendar and microdose your way into deeper money connection. And yes, you can do money dates whether you’re solo or partnered!

Need help running a money date? I’ve got you. I share my money date tips to help you create healthy financial routines here.

8. Write Down Your Financial To-Dos

Stop letting financial tasks swirl in your brain. You know that nagging feeling that you’re forgetting something? It often lives in your mental money to-do list. Instead, get it out. You can write it on a piece of paper, into your Notes app, or wherever works for you. Writing down “roll over old 401k” or “close out old credit union account from college” helps free up mental space and makes those tasks feel more manageable. Bonus: These notes become a great agenda for your next money date.

9. Try the Eisenhower Matrix

If your financial to-do list feels like a mountain, try the Eisenhower Matrix. This tool helps you sort tasks into four buckets: Do Now, Do Later, Delegate, or Delete. It’s an incredibly helpful way to cut through the noise and identify what actually matters. I go into this method in more detail in this post and video, but if you need a quick-start tool for organizing your money life, this is it. Perfect for those stuck in “I know I need to do something, but where do I even start?” mode.

Building Money Habits That Stick

Microdosing financial habits is a gentle, effective way to build trust with yourself and make progress without the pressure of perfection. Whether you’re trying to create smart money habits, looking for easy money moves, or actively healing your relationship with money, these micro-steps can help you move forward.

And if you’re already doing some of these things? Congrats, you are well on your way to financial wellness!

Want more nuanced financial tips? Make sure you’re subscribed to my weekly Mind Money Balance newsletter here and join thousands of others who reply with things like, “This is the first time I’ve replied to a newsletter, because I was moved by the thoughtfulness of it.”

More Like This

Prioritize Money Goals & Decisions With The Eisenhower Matrix

Money Dates: Sharing My Money Routines