Loud Budgeting is just Financial Boundaries

What is Loud Budgeting?

Nothing like a social media trend to get us talking about a money trend I can get behind! So, what is loud budgeting? The term "loud budgeting" was propelled into the spotlight by TikToker Lukas Battle, who coined it as the antidote to quiet luxury that dominated the cultural zeitgeist in 2023 (remember? It was very Succession-coded, no brand names showing). “Loud Budgeting” emphasizes transparent communication regarding spending limits.

When I heard about this trend, I was very on board. Because “loud budgeting” is what we’d call in the therapy world “verbalizing your boundaries.”

Understanding Boundaries: Dispelling Misconceptions

Boundaries have to be one of the most commonly misunderstood terms. I’ve seen people on social media get it wrong–and boldly–by claiming it’s about controlling others. To be crystal clear, boundaries are NOT about controlling or changing others; they're about clarifying what works for us.

Think of them as our personal guardrails, guiding us towards emotional safety and financial well-being. A boundary is how we tell someone else what we will and won’t tolerate. It's about saying, "Here's my space, here's what's cool, and here's what's not." Boundaries are also flexible. You might need a more rigid emotional boundary at one point in your life, and be safe and comfortable having a more flexible boundary in the future.

Knowing Your Financial Boundaries

Before you can participate in “loud budgeting,” you have to know your current financial goals and be clear about what you won’t be spending money on–temporarily–to achieve them.

Some things you need to know:

How much are you earning each month?

How much are you spending each month?

Are there ways to increase your income?

Are there ways to decrease your spending? (The three largest expenses for Americans in 2023 were housing, transportation, and food–start there if you’re stuck on areas to cut back on!)

Loud Budgeting isn’t a Cop-Out

One thing I’ve noticed as I’ve watched this trend circulate is that some creators are using it as an excuse to be reclusive or say no to staying connected with their friends and family. AKA, they are using it as a scapegoat for invitations they’d rather say no to, but don’t have a good reason to say no. Loud budgeting is NOT a way to stop engaging with your social circles; rather, it’s a way to practice vulnerability by sharing with them your financial goals and suggesting other low- or no-cost activities to stay connected with them instead.

Third Spaces and Spending Money

In the U.S. so much of our socializing revolves around spending money. Why? Well, sociologists would say the U.S. is lacking in "third places." A “third place” is a place people gather that isn’t their home (your “first place”) or work (your “second place”). Third places offer a sense of community and relaxation without the pressure of formalities or obligations. However, many of these third places come with a price tag in the United States. Think about your favorite coffee shop, where lingering over a cup of coffee may require periodic purchases to access amenities like Wi-Fi. Even dining out often comes with a not-so-subtle nudge to leave the premises as soon as you’ve paid your bill.

Other parts of the world have more accessible third places, where you're welcome to linger without feeling rushed or obligated to spend money. If you are struggling to stay connected while practicing loud budgeting, some third place examples where you can meet up with friends are places like parks, libraries, dog parks, community meet-ups, playgrounds, community centers, or museums.

Loud Budgeting By Communicating Boundaries

Picture this: You're at a crossroads between splurging on brunch and saving for that dream vacation. We've all been there! Loud budgeting nudges us to communicate our financial boundaries clearly. In this instance, the loud budgeting example might sound like, “I’d love to do brunch, but I’m saving up for a vacation, so I’m saying no to dining out until I’ve saved up for it. Could I join you for a walk after?” It's about honest conversations with friends and family, without the guilt trip or awkward silences.

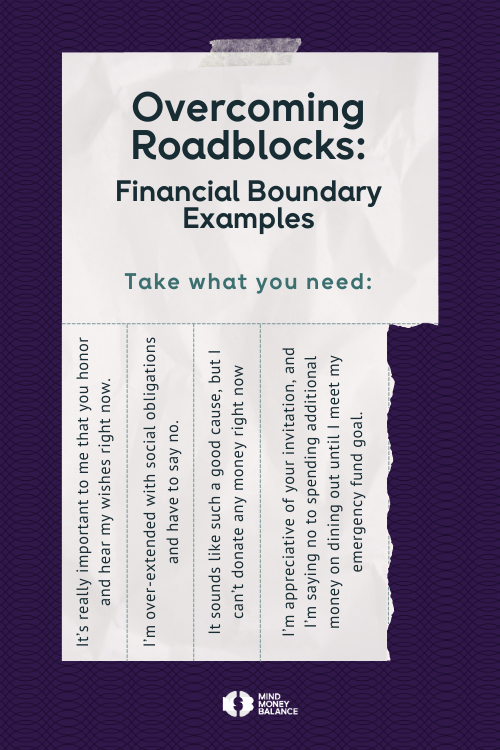

Overcoming Roadblocks: Financial Boundary Examples

Setting financial boundaries as you practice loud budgeting is bound to have some roadblocks.

One common roadblock is dealing with people who are the naysayers of your newfound bold and loud boundary-setting. The people who have typically benefitted most from our lack of boundaries are usually the ones who will push back the hardest when we start setting boundaries. It’s good to be prepared for this external resistance and to practice some scripts to say no.

Here are a few financial boundary examples in script form that might help:

I’m so appreciative of your invitation, but like I shared, I’m saying no to spending additional money on dining out until I meet my emergency fund goal.

It’s really important to me that you honor and hear my wishes right now.

I’m over-extended with social obligations and have to say no.

I need to take a break from this pressure/conversation. If you want to revisit this conversation, let’s talk about it [in a few hours, tomorrow, this weekend]

It sounds like such a good cause, but I can’t donate any money right now

I’m not willing to put things on my credit card [right now/this year/this month]

When it comes to setting financial boundaries with family, you might need to practice repeating yourself more than usual. Addressing resistance can feel so uncomfortable, but with time, you’ll usually build resilience and feel safer asserting your needs. While navigating family and social dynamics can be tricky, it’s not impossible AND it can help you achieve your financial goals when people know why you are temporarily saying “no.”

Cheers to Loud Budgeting!

So, there you have it—loud budgeting in a nutshell! It's not just about numbers; it's about empowerment and authenticity. By embracing our financial boundaries and having those candid money talks, we can improve the odds of us meeting our financial goals. Along the way, we’ll have strengthened our communication skills, and hopefully inspired others to be more transparent about their money goals, too!

Think the concept of loud budgeting would n resonate within your organization or community? Then consider bringing me in to help folks understand the strategies for cultivating financial wellness. With more employees indicating they want their companies to provide help with financial wellbeing and surveys showing that investing in financial wellbeing boosts’ oranizations bottom line you can support your team and you can spark meaningful conversations and change. Reach out today!